Smaller deals drive activity

By Joshua Ohl

CoStar Analytics

January 17, 2025 | 8:08 AM

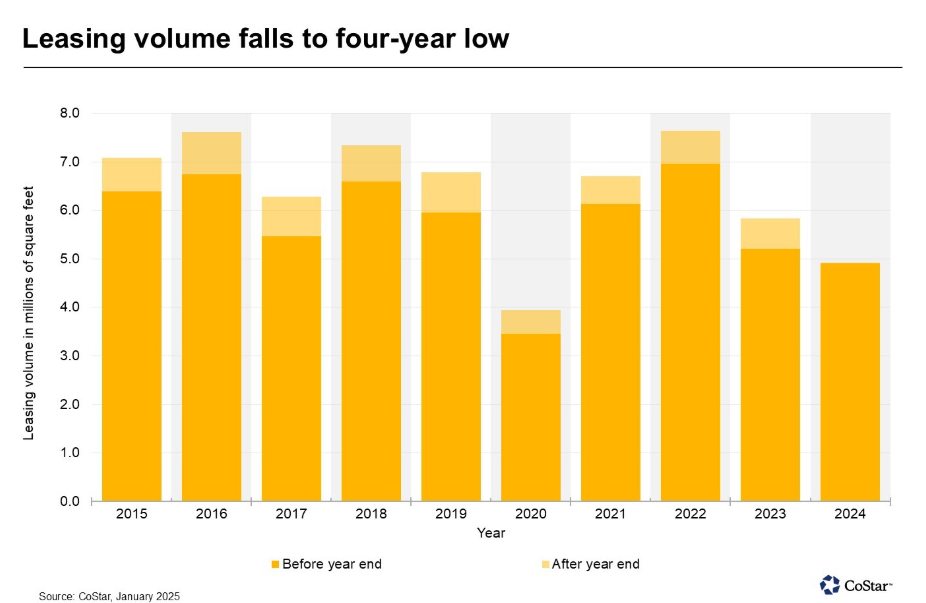

San Diego’s office market endured an underwhelming year for leasing in 2024. The region experienced its lowest leasing volume since 2020 when less than 4 million square feet of office space was leased following the onset of the pandemic.

Although CoStar’s research team will continue collecting lease transactions through the early stages of 2025, only about 5 million square feet of space was leased last year. That was 800,000 fewer square feet than in 2023, and roughly 25% lower than the average between 2021 and 2023. It was also nearly 30% below last cycle’s average between 2015 and 2019.

That came as more than 200 fewer leases were signed in San Diego compared with 2023. If that holds, aside from 2020 it would mark the fewest deals signed in a calendar year since 2009.

One trend has become clear in San Diego’s office leasing market: Small deals are driving leasing volume across the region.

Last year, 50% of leasing volume was for spaces smaller than 5,000 square feet. That continued the trend that started in 2023 when that happened for the first time in more than a decade. The average new lease signed in 2024 was 2,900 square feet, which was 15% smaller than the average new lease signed between 2015 and 2019. In the past 20 years, only 2009 and 2020 had a lower average lease size.

Leasing at the top of the market among the largest occupiers has still not recovered; those firms have continued to downsize their footprints into smaller spaces when executing new leases. They have increasingly pivoted toward maximizing space efficiency during peak attendance in the office during the work week, often resulting in taking on less space.

In downtown, for instance, most law firms and accounting firms have occupied less space than in the past, and many of those with space decisions looming expect to do the same. While there had been anticipation that the San Diego city government might take on a substantial amount of new space downtown, that may not come to fruition due to a budget deficit.

During the past two years, only about 15% of leasing volume was filled by spaces larger than 25,000 square feet. Before 2023, that percentage averaged closer to 25% of leasing volume.

While the occupancy losses that have spread across major office markets in the U.S. since 2020 have not been nearly as dramatic in San Diego, there is general agreement among local brokers and operators that new leasing volume will remain below pre-pandemic trends.

(Posted with permission by CoStar)