Although Current Distress Levels Are Low, Office Properties Backed by Nonperforming CMBS Loans May Signal Potential Defaults

By Nancy Muscatello

CoStar Advisory Services

October 7, 2022 | 8:09 A.M.

Persistently higher rates of remote working since the pandemic have plagued the office market, acting as a governor on demand growth and leading to higher vacancies. Now, the declining macroeconomic environment presents another headwind for the property sector.

Expected layoffs stemming from a potential recession would exacerbate the lower demand for office space that property owners are already facing in trying to maintain building occupancy and revenue. The amount of vacant office space nationally has reached 12.4% of inventory, the highest level since 2011. Sublease space availability is also rising, and asking rents, while showing positive year-over-year growth, have yet to recover to pre-pandemic levels nationally. On top of remote work pressures, rising interest rates and the increased likelihood of a recession may lead to distress and forced sales as refinancing challenges increase.

Current levels of distress in the office market are relatively low, with sales volume down modestly from earlier in the year as deals continue to transact, and delinquency rates have yet to move up significantly from levels reached over the past year. A gauge of where the distress may surface first, when and if it does begin to rise, can be seen through an analysis of office properties backed by an active commercial mortgage-backed security loan using CoStar data. Of the roughly 913 million square feet of office properties that are backed by an active CMBS loan, 12.7 million square feet, or only about 1.4%, are delinquent, with the lion’s share of that total more than 90 days delinquent. An additional 15 million square feet of office properties are in foreclosure, at maturity default or have already been returned to the lender.

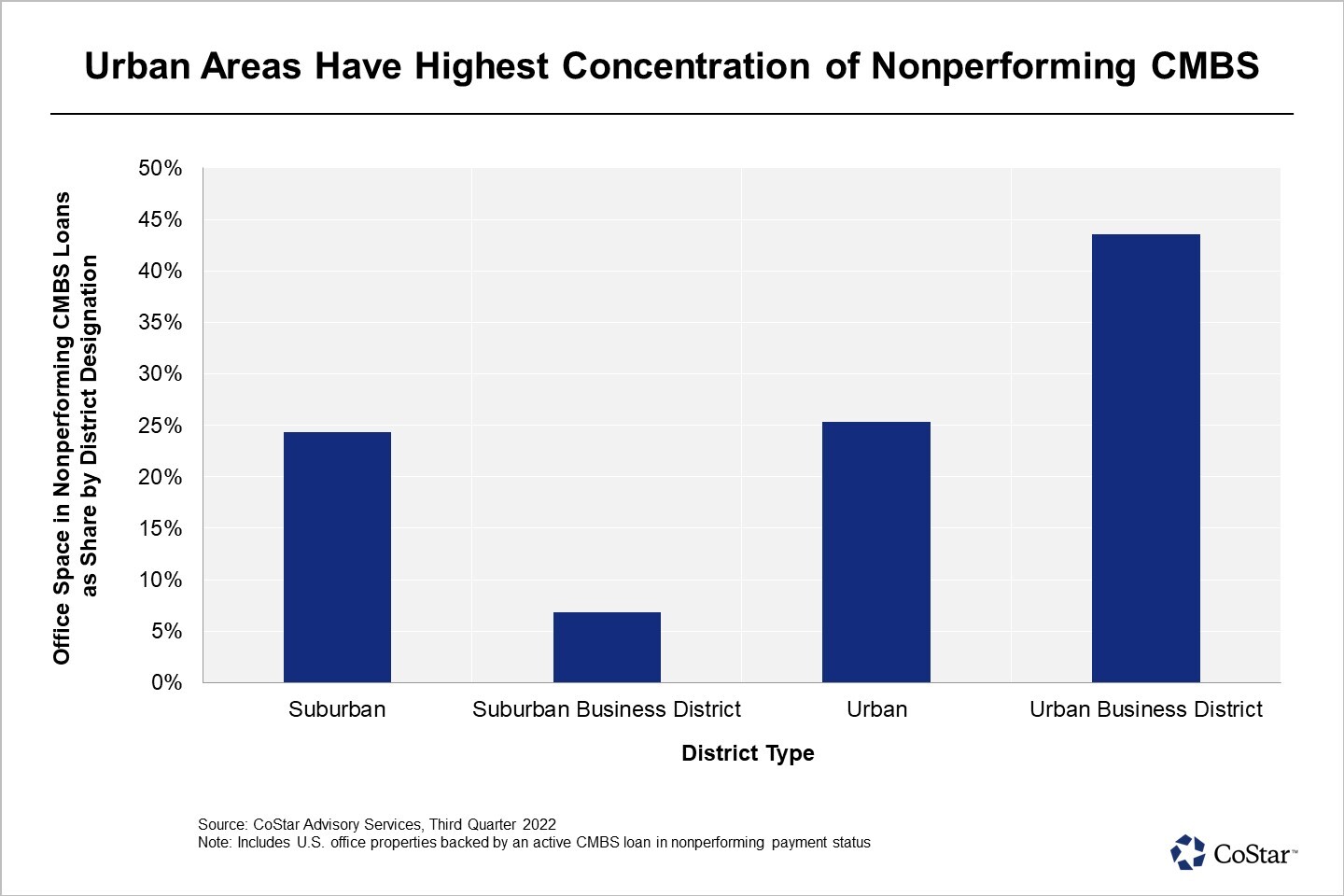

The location, age and quality of office assets in nonperforming loan categories suggest what segment of the market is likely at greater risk. Two-thirds of the office square footage in the nonperforming loan category is located in urban areas, with the vast majority of that concentrated in urban business districts. This is modestly above the 60% share urban office properties occupy in all active CMBS loans. Additionally, over 70% of the office space backed by an active CMBS loan that is nonperforming is in buildings built before 1990. On top of that, many of these aging buildings are suffering from elevated vacancy rates.

The level of distress in the office market is likely to increase. As we move into a softer economic environment, the shift in demand toward newer, high-quality space is expected to further exacerbate pressure on property owners of aging office buildings already struggling with significant vacancy. Declining rental income and accelerating operating costs in an inflationary environment is expected to lead to debt payment and refinancing issues for some owners, particularly for those of older buildings that are no longer competitive with the modern office space that tenants are seeking.

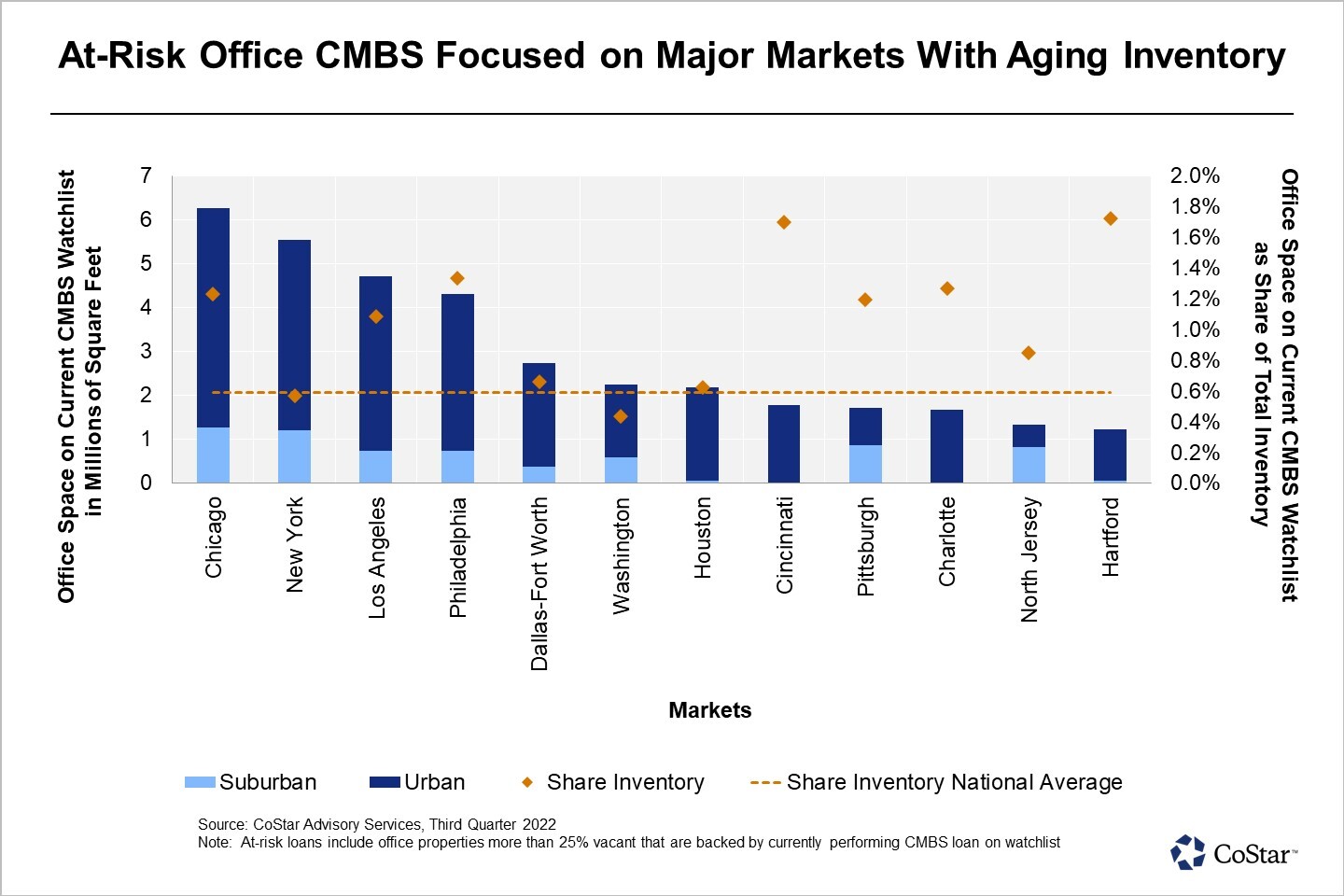

Further segmenting the CMBS data shows that at-risk office properties are focused in major markets. Office properties with significant vacancy of 25% or higher, and on a loan servicer’s watchlist, which includes loans that have early indications of potential distress, are concentrated in Chicago, New York, Los Angeles, Philadelphia, Washington and Houston. Nearly 80% of that at-risk space is concentrated in urban districts within those major markets.

While the nominal square footage of high-vacancy office properties on a watchlist is lower in other markets such as Cincinnati, Pittsburgh, North Jersey and Hartford, Connecticut, the at-risk space as a share of the total office inventory in those markets is well above the national average. Being on a watchlist is not a guarantee of a property loan moving into distress, but it is an indication of higher risk.

Certainly, loan servicers who are willing to work with borrowers to grant relief would mitigate some risk. Still, many of the problems going forward are likely to occur in markets with a higher share of older office inventory that is not desirable to tenants in the current environment.

The weaker outlook for the economy and labor market is expected to weigh on commercial real estate pricing and increase levels of distress. With the office sector still reeling from increased remote working levels since the onset of the pandemic, it may be more acutely affected by an economic downturn than some of the other major property types, including industrial and multifamily. Occupancy-challenged office properties in markets with an aging inventory are expected to be most affected.

While the headwinds facing the office market have increased, a subsequent reset in pricing should create opportunities for investors looking for distress properties, particularly with near-record amounts of available investment capital on the sidelines still waiting to be invested.

(Posted with Permission by CoStar)